A Quarterly Look at Housing and the MREIT Sector - Residential Still a Bright Spot with Bond Outlook Improving

- Jonathan Poyer

- Oct 29, 2024

- 2 min read

Mortgage REITs (represented by FTSE NAREIT Mortgage Plus Capped Index) returned an impressive 9.6% for the quarter. However, mortgage REITs generally underperformed the broader equity REIT index. Much like previous quarters, performance in the mortgage REIT market was nuanced depending on capitalization and underlying exposure.

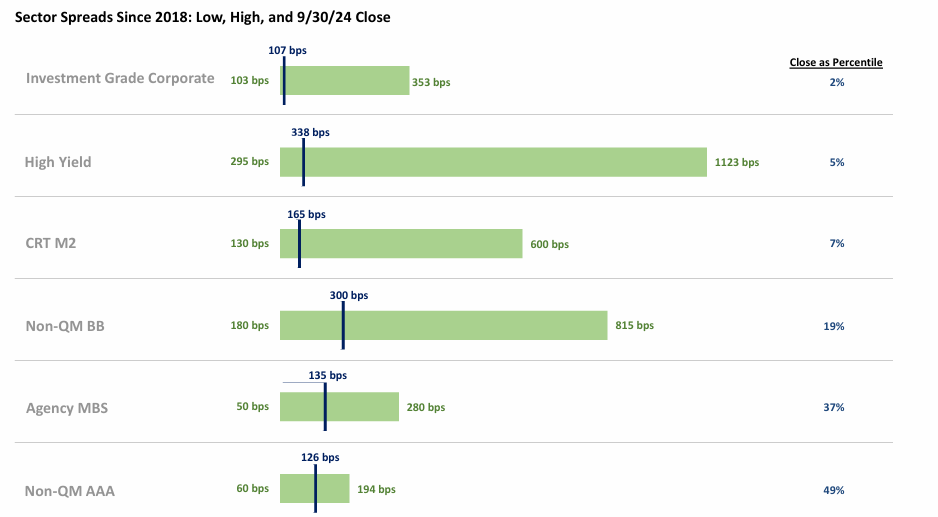

We believe mortgage REITs to generally report higher book values for the quarter given stable credit spreads, lower rates, and the tightening in the Agency MBS basis. Certain non-agency residential mortgage REITs ended the quarter still trading at sizeable discounts to tangible book value and double-digit dividend yields. In addition to normalizing price to book ratios, we continue to believe book values have material upside as interest rates likely subside and credit spreads tighten to reflect the lack of fundamental risk in parts of the mortgage market.

We believe several residential mortgage REITs should be able to pay double digit dividends and are using relatively safe forms of leverage.

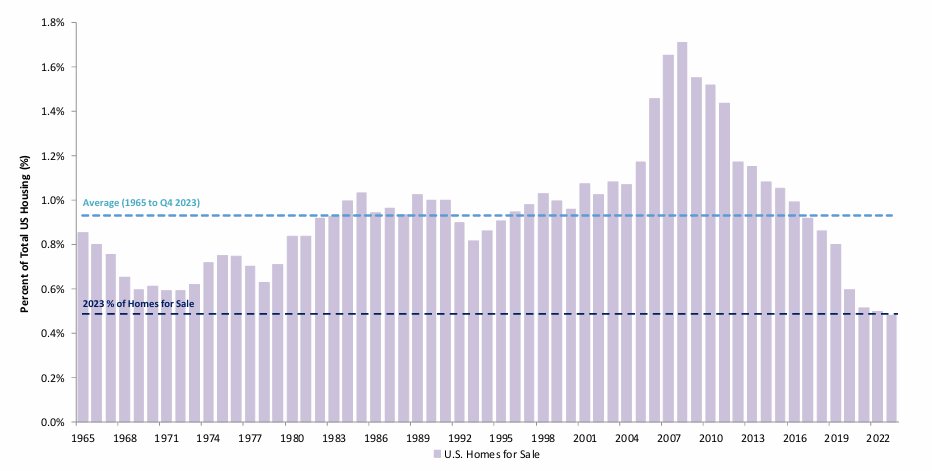

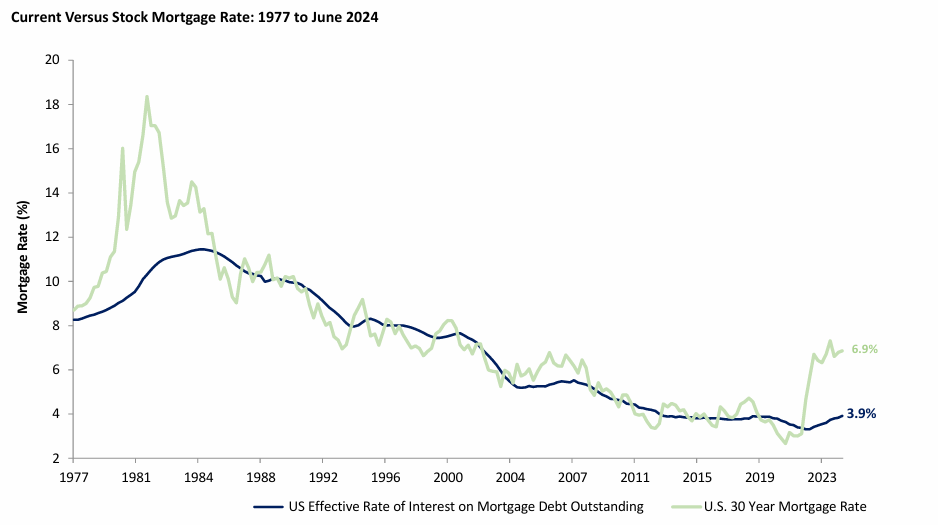

Single-family housing will likely remain the bright spot in the real estate market. Single-family residential mortgages do not face the refinancing risk that commercial real estate is dealing with since residential mortgages tend to be fixed for 30 years vs. much shorter maturities typically for commercial real estate. An underproduction of residential housing over the last decade, combined with mortgage borrowers’ unwillingness to give up their low mortgage rates, is likely to result in continued low housing supply.

While there has been a recent slight uptick in housing supply coming from new construction, distressed selling is required to drive prices down meaningfully, and a historic amount of borrower equity is likely to prevent this. While home prices may likely decline in some urban areas and parts of the country that saw outsized appreciation over the last few years, on a national level, home prices are likely to be stable.

Mortgage rates are likely to remain elevated in the short term but slowly decline in 2025. The decline in mortgage rates could be relatively muted as we anticipate the yield curve to continue to normalize, which means that yields at the long-end of the curve will not decline as much as on the short-end. Also, part of the decline may likely be from the tightening of the “basis” between Agency MBS and Treasury yields which remains wide relative to the historical average.

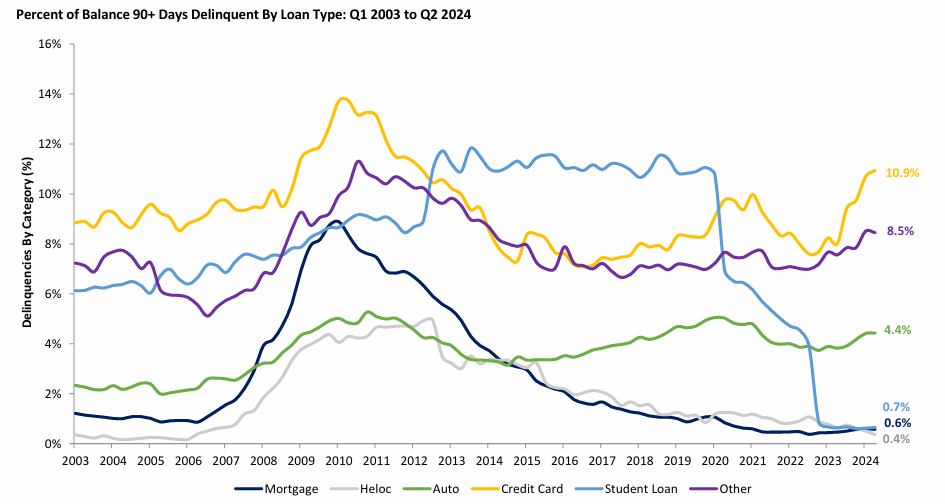

Residential mortgage defaults are likely to remain low given the aforementioned dynamic of borrower equity as well as a resilient economy. While we wouldn’t bet on significant home price appreciation in the short term, we believe the way to play stability in the housing market is by investing in certain RMBS, corporate credit, and mortgage related equities.

Also, given the “trapped equity” that many people have in their homes, we are likely to see increasing origination in second lien mortgages, reverse mortgages, and home equity investments

Comentarios