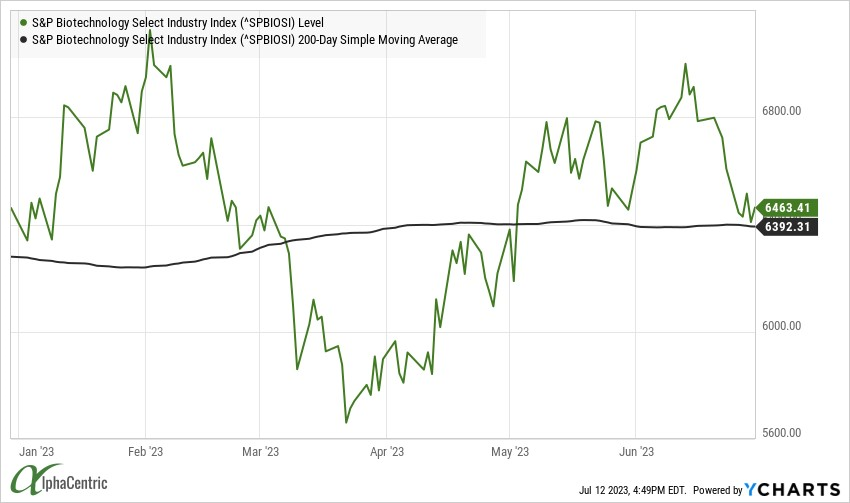

The S&P Select Biotech Index was threatening to break out of the recent trading range through mid-June, powered by M&A and positive clinical/ regulatory updates, but pulled back ~10% to the 200-day moving average.

In contrast, tech stocks chased higher as AI favorites Nvidia (NVDA) and Microsoft (MSFT) gained a staggering +$1.5 trillion of market capitalization YTD, which is higher than the aggregate current total market capitalization of all n=150 components in the S&P Select Biotech Index combined.

Biotech investors cheered on M&A as new deal announcements continued despite the Federal Trade Commission’s (FTC) unprecedented legal challenge to Amgen’s (AMGN) pending ~$28 billion acquisition of Horizon Therapeutics (HZNP).

The FTC broke new ground by arguing AMGN might theoretically pursue a bundled rebate strategy with some of the orphan drugs acquired from HZNP as the primary basis for attempting to block the proposed merger. This is the first biotech/pharma deal challenged by the FTC since 2009, and legal scholars suggest that the FTC is in a weak position given the deal passes historical anti-trust standards evaluating commercial overlap. Ironically, HZNP itself acquired each of the orphan products that constitute the vast majority of the deal value through a series of their own M&A transactions that were approved by the FTC in recent years. HZNP shares trade at only a ~10% discount to the announced acquisition price, suggesting the market believes the legal challenge will be defeated and the deal will close.

Swedish Orphan Biovitrum (SOBI SS) announced and completed the acquisition of CTI BioPharma Corp. (CTIC) during the quarter in a deal valued at $1.7 billion. The deal was a ~90% premium to the prior day’s closing price and ~2.5x consensus revenue estimates in 2030 and did not draw any scrutiny from the FTC.

Likewise, deal spreads for the series of pre-commercial M&A deals announced in the quarter are quite narrow as the market is suggesting the FTC will not even attempt to block them. Specifically, Astellas Pharma (4503 JT) reached a deal to acquire Iveric Bio (ISEE) for $5.9 billion. The deal was only a ~20% premium to the prior day’s close as there was takeout speculation already in the stock.

Novartis (NVS) announced an agreement to acquire Chinook Therapeutics (KDNY) for $3.2 billion upfront plus $300 million as contingent value right payments. The $40 upfront cash price represented a ~67% premium to the prior close.

Ironwood Pharmaceuticals (IRWD) announced plans to acquire VectivBio Holdings (VECT) for ~$1 billion or ~40% premium to the prior day’s closing price. VECT is developing apraglutide, a synthetic GLP-2 analog currently in a Phase 3 trial for Short Bowel Syndrome with Intestinal Failure (SBS-IF). Data from this pivotal trial is expected later this year.

Eli Lilly (LLY) is perhaps the least exposed big pharma to a near term patent cliff, but they still joined the M&A party with a deal for Dice Therapeutics (DICE). The $2.4 billion takeout was a ~40% premium to the prior day’s close and continues the recent trend of going earlier. DICE completed an early phase I clinical trial with their lead oral IL-17 inhibitor and has only recently started dosing patients in a phase 2 trial.

BioMarin (BMRN) continued the streak of high profile regulatory approvals with FDA clearance of the first gene therapy for hemophilia A. BMRN plans to price Roctavian at $2.9 million per patient and reiterated its FY 2023 guidance of $50-$150 million implying n=25-75 patients will be dosed in the next ~6 months.

The FDA approved another gene therapy by giving the nod to Krystal Biotech’s (KRYS) Vyjuvek for patients with dystrophic epidermolysis bullosa (DEB) with mutation(s) in the collagen type VII alpha 1 chain (COL7A1) gene. List price equates to >$1 million per patient per year for induction and ~$600k for maintenance use, leading KRYS to estimate a >$750 million global market opportunity despite there being only ~3000 DEB patients in the US. KRYS hit an all time high on the news.

Finally, Seres Therapeutics (MCRB) announced the watershed regulatory approval of oral microbiome therapy Vowst for the prevention of recurrence of C. difficile infection. The therapy will be priced at $17.5K per course and is the first microbiome therapy approval by the agency.

Culling of the development stage herd is now expanding to large cap players with Novartis (NVS) reporting it was cutting 10% of its clinical pipeline (n=20 phase 1 and 2 programs). Likewise, Biogen (BIIB) also announced it was cutting several phase 2 and 3 programs. Lanett Co (LCI) announced it was filing Chapter 11 bankruptcy as the spec pharma company looked to restructure debt and Sangamo Therapeutics (SGMO) announced a 27% reduction in force.

Even high flying Illumina (ILMN) that trades >50x 2025 PE highlighted that it will reduce annualized run rate expenses by more than $100M beginning later in 2023 which will accelerate progress toward higher margins. PTC Therapeutics (PTCT) announced discontinuation of preclinical and early research in gene therapy, the departure of the CFO and a 15% OPEX cut. PTCT is guiding FY23 revenue to be nearly $1 billion, but has less than one year of cash on the balance sheet at the current burn rate. Cyteir Therapeutics (CYT) announced a plan of dissolution despite having $137 million of cash and trading negative $69 million EV at the time of the announcement.

CYT shares are up ~30% since on anticipation of cash return. Eiger Biopharmaceuticals (EIGR) announced a 25% reduction in force, a new CEO and strategic focus on metabolic diseases. Both Novan (NOVN) and Greenlight Biosciences (GRNA) announced 50% reductions in force. Quality is improving across the sector with these initiatives to improve capital efficiency and eliminate spending on marginal programs.

Deal activity is expected to be concentrated on differentiated development stage assets with multi-blockbuster potential and commercial stage niche assets with the potential for near-term accretion. Recent willingness to take on significant clinical and regulatory risk in M&A deals bodes well for improved sentiment across the sector.

The ‘artificial’ discount of the biotech sector relative to tech may have just reached a record.

Comments