September got off to a volatile start with market darling Nvidia (NVDA) erasing ~$280 billion in the largest single day destruction of market capitalization in history. Curiously, the move down came without and major new company-specific headlines highlighting the impact of the momentum factor.

The S&P Select Biotech Index remained above the 50-day moving average as traders are still pricing in ~100 bps of rate cuts this year.

Volatility is expected to pick up heading into seasonally weak September / October, but analysts are predicting a brighter future for biotech with the cutting cycle underway and the election in the rear-view mirror.

Regulatory:

Embecta (EMBC) received 510(k) clearance from the FDA for its proprietary disposable insulin delivery system, with a tubeless patch pump design with a 300-unit insulin reservoir.

Clinical:

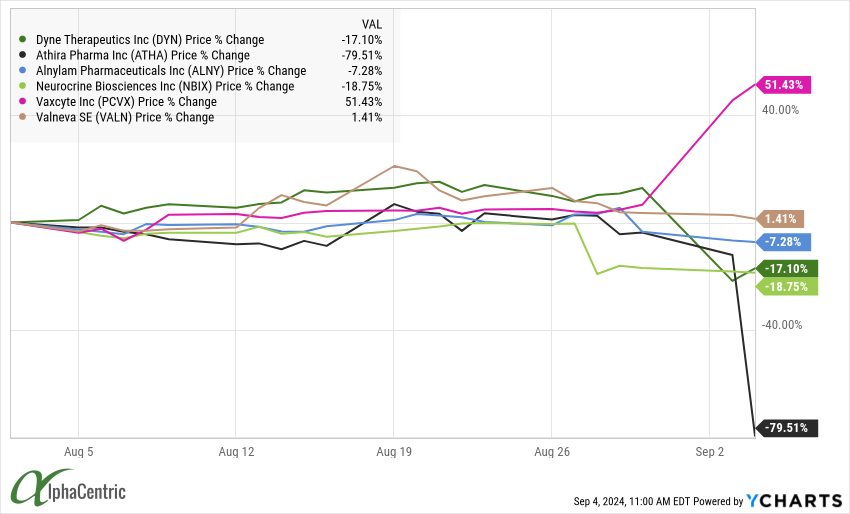

Dyne Therapeutics (DYN) announced updated data in Duchenne Muscular Dystrophy (DMD) patients that showed impressive dystrophin expression (+3.71% unadjusted, +8.72% adjusted) and improvement in some functional measures, but shares initially fell as two patients in the 40 mg dose group had a severe adverse event. DYN also announced turnover in the CMO, CBO and COO roles helping push shares down ~30%.

Athira Pharma (ATHA) announced the Phase 2/3 LIFT-AD clinical trial of Fosgonimenton in Alzheimer's Disease failed to meet the primary endpoint of GST and key secondary cognition endpoints. Shares crashed >75% as the path forward seems challenged, especially given the fraud accusations that ousted the founding CEO.

Alnylam Pharmaceuticals (ALNY) were under pressure after releasing the full results from Amvuttra's pivotal trial in ATTR amyloidosis with cardiomyopathy that showed later separation of benefit then analysts had hoped raising questions on competitive positioning.

Neurocrine Biosciences (NBIX) reported Phase 1 dose ranging data with oral, muscarinic M4 agonist NBI-1117568 that showed mixed results. The lowest 20 mg dose met the primary endpoint of PANSS total score (7.5 points vs placebo), but the magnitude of benefit was lower compared to competitors (BMY, ABBV showed 10-12 points vs placebo) ) and higher doses showed diminished benefit.

Vaxcyte (PCVX) released positive Ph1/2 data for VAX-31 PCV in adults aged 50 years and older indicating all serotypes met immunogenicity criteria at the highest doses. VAX-31 will be advanced into pivotal trials with data expected in 2026.

Valneva (VALN) and partner Pfizer (PFE) announced positive data from VLA15-221 Phase 2 following a second booster vaccination of their Lyme disease vaccine candidate.

Corporate Updates and Earnings:

GSK (GSK) announced Delaware's top court will review the admissibility of expert evidence in claims related to Zantac's alleged cancer risk, potentially limiting the liability exposure.

Avadel Pharmaceuticals (AVDL) announced a Delaware court denied a request from competitor Jazz Pharmaceuticals (JAZZ) for a permanent injunction on sale of Lumryz in the US, but granted JAZZ's request to block approval for isiopathic hypersomnia (IH) until expiry of patent 11,147,782 (projected expiry in 2036).

Eli Lilly (LLY) announced it will start selling obesity therapy Zepbound vials at 50% discount to shots via a direct to consumer website. The vials will require patients to fill the syringe on their own, but will also be easier to manufacture compared to the auto-injector pens.

Culling the Herd:

BioMarin Pharmaceuticals (BMRN) announced plans to cut the workforce by 225 employees.

Repare Therapeutics (RPTX) will lay off 25% of the workforce mostly in preclinical R&D to focus on the clinical pipeline.

Comentarios