Across most new issue non-agency RMBS bonds, credit spreads were only slightly wider for the first quarter. On the Agency (government guaranteed) MBS side, the “basis” (or spread over Treasury bonds) was also only marginally wider for the quarter. On a price basis, MBS prices rose slightly for the quarter as the 10-year Treasury yield went from 3.88% to 3.48% by the end of the quarter.

Housing data continued to meet our expectations of relative “stickiness.” CoreLogic HPI in February was up 0.8% MoM and 4.0% YoY. Home prices were down a modest 3% from the peak in 2022, although there was regional differentiation with more weakness in the Sunbelt and West Coast markets.

In 2008, residential real estate was the center of the economic storm. Now, we believe residential housing could be the shelter from the storm. Low housing inventory, a result of various underlying factors, will likely be the major driver of resilient home prices over the short to medium-term. Homes for sale is the lowest in 57 years as the percent of U.S. homes for sale was 0.50% of total U.S. housing. This is a theme we have seen over the past few years - there is very low supply for those trying to buy a home.

The sale of existing homes, where homeowners own but need to sell, has been declining. There is a significant opportunity cost to sell an existing home in the current mortgage market. New sales have picked up, even with low inventory.

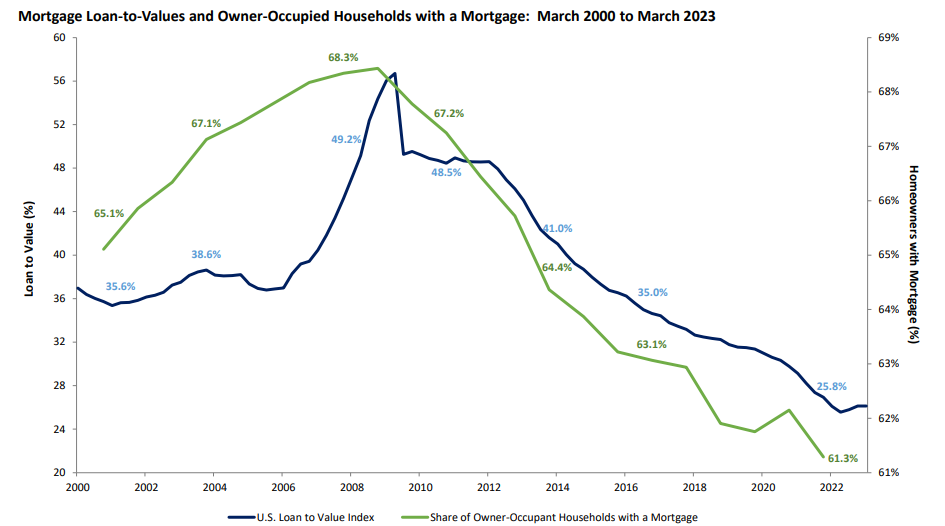

The absence of a “cash-out refi” boom (which is what took place in the mid-2000s) has left many mortgage borrowers with a significant amount of home equity in addition to a low mortgage rate. 2.1% of mortgaged U.S. homes have negative equity, the lowest since 2012 at the least. At the same time, U.S. homeowners now more than in recent memory own their homes outright; nearly 40% of homes are owned outright. The overall LTV in the market is 25.8% and continues to improve year over year as it has for at least the past 15 years.

A major aspect of the housing market has to do with mortgage rates. In fact, we think of a homeowners balance sheet to show the mortgage as the asset and the house as the liability; a great inversion from what has historically been the case. Today, in contradistinction to before the GFC, only 2% of all mortgages are adjustable rate (ARMs). Compare that to nearly 50% in 2005-2006.

The average interest rate is now 3.5%. There is a significant cost to moving.

For the remainder of 2023, we think the best way to take advantage of stability in the residential housing market will likely be residential mortgage credit.

Comments