Investor sentiment for mortgage related equities improved modestly this week although many securities continue to trade at distressed prices. We believe the next major catalyst for higher prices will be Q1 earnings releases for mortgage REITs and servicers over the next few weeks. One interesting event this week was big bank earnings releases. While banks are a different animal versus non-bank mortgage companies and REITs, some important information can be gleaned.

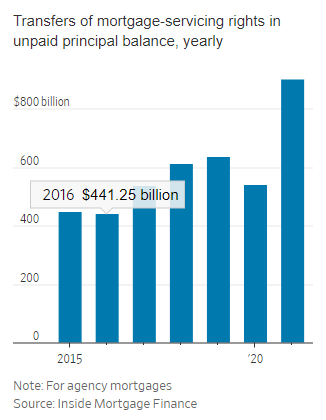

Check out this article in the WSJ (3/29/2022) on mortgage servicing rights:

See below excerpt from a wall street research piece published this week regarding the mortgage servicing aspect of the banks –

“Mortgage Servicing: For the four banks (JPM, PNC, USB, WFC), mortgage servicing right (MSR) valuations improved 20% Q/Q, on average (range of 13%-25%). During 1Q, primary mortgage rates and 10Y UST yields increased 145 bp and 83 bp, respectively. Despite the increase in rates, the increase in MSR valuations was better than our expectations. Given that the bond market sell-off has continued, we think that valuations have probably increased further QTD. We see the MSR strength as a positive read[1]through for owners of servicing assets such as COOP and NRZ, and to a lesser extent TWO, PFSI, and PMT.”

Higher rates are a boon to the valuation of MSRs. NRZ and COOP are the largest non-bank holders of MSRs.

Some MSRs in the market:

Ocwen Financial (OCN) corporate bonds – 4 year maturity and ~11% yield

Starwood Property Trust (STWD) common shares – 8% dividend yield, insulated from rising rates by originating low LTV, floating rate loans, solid management

Pennymac Financial Services (PFSI) common shares – mortgage originator/servicer with attractive MSR book, trades at ~20% discount to book value

MFA Financial (MFA) common shares – non-agency mortgage REIT, modest leverage, ~12% dividend yield, ~25% discount to our estimation of book value

Taking a deep value approach will be rewarded this year as interest rates are poised to rise and growth stock multiples will be under pressure.

Comments