What is a mortgage REIT and can these tools help investors gain access to residential real estate?

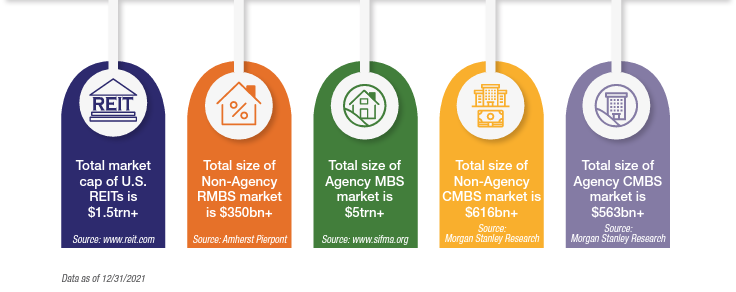

Mortgage REITs ("mREITs") are REITs that invest in debt backed by residential housing or commercial real estate. They purchase mortgages on the secondary mortgage market - they purchase mortgage debts.

After a bank lends money to someone buying a house, the bank sells that mortgage to a mortgage buyer (an mREIT).

An mREIT can invest in government backed (agency) or non-agency mortgage backed securities, mortgage loans, etc.

Unlike equity REITs, mREITs do not own, manage, and develop properties. Instead they make money on the interest they charge for providing real estate loans; they leverage large amounts of debt to receive revenue in the form of interest.

Investors can buy into mREITs by buying shares in the companies, which are publicly traded on a stock exchange. Some examples: New Residential Investment Corp. (NRZ), Ellington Financial (EFC), MFA Financial (MFA), Starwood Property Trust (STWD). There is the potential to receive attractive yields from these investments as they deliver dividends. mREITs must pay at least 90% of their income to shareholders, which means that the income in not taxed to the REIT but is instead taxed as ordinary income to the shareholder.

mREITs borrow money at short-term interest rates and lend it at rates near the higher long-term bond rates. Since mortgage rates are ties to the higher, long-term bond rates, mREIT profits are directly proportional to the spread between long-term and short-term rates. If rates rise, mREITs see an increase in their dividend income.

So how can they help investors?

Relatively high dividend yields through prudent use of leverage

Many REITs now use longer term debt with little mark-to-market risk on financing

Taint from the pandemic still causing some REITs to trade at a discount to book value

Opportunity to find overlooked sources of book value and returns

Many mortgage REITs own mortgage servicing rights, which may appreciate in value with rising interest rates

Outside of the great financial crisis, residential real estate has only had 2 down years in the past 40 and has been positive in 10 of the past 11 recessions. Mortgage REITs may be a good investment strategy to hedge against inflation and a recession.

Comentários