October Marked the 13th Time in the Past 34 Months That Bonds Declined Alongside Equities. We Need Another Solution to Bonds

- Jonathan Poyer

- Nov 8, 2024

- 2 min read

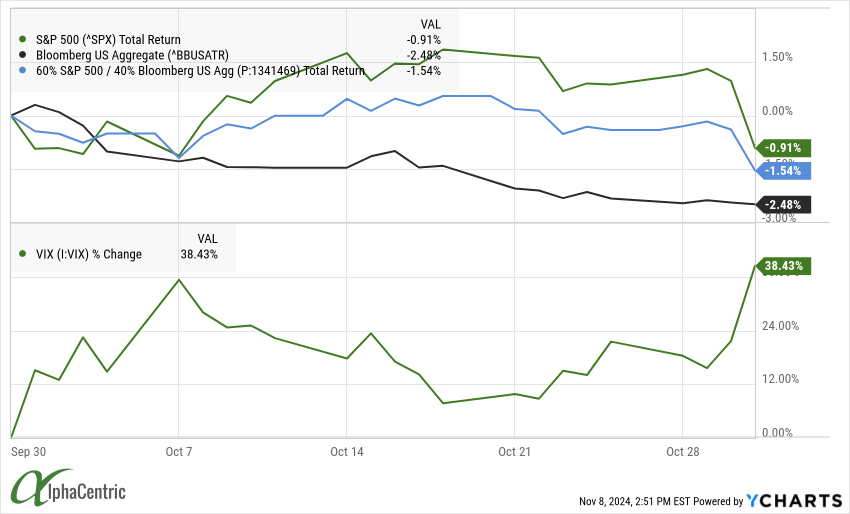

The VIX finished October at 23.6, slightly higher than earlier in the year but still well within historical levels and showing that the August blip was indeed a blip. Interesting enough, to start November, the VIX dropped considerably following the election and as of 11/6 was at 16.27.

For the month, the S&P 500 finished down -0.91%, the AGG down -2.48%, and a 60/40 portfolio down -1.54%.

The month also reinforced an ongoing challenge investors face in the current market environment – the diminishing effectiveness of bonds as a diversification and hedging tool. October marked the 13th time in the past 34 months that bonds declined alongside equities, a stark contrast to the previous 13 such concurrent declines needing a full 100 months (3 times as long) to occur.

Historically, stocks and bonds rising at the same time is quite common:

% of Years Stocks & Bonds Rise Together | |

1930s | 40% |

1940s | 70% |

1950s | 30% |

1960s | 60% |

1970s | 60% |

1980s | 70% |

1990s | 70% |

2000s | 50% |

2010s | 75% |

However, stocks and bonds both declining at the same time is quite rare. In fact, it has only occurred 3 times since 1928! 1931, 1969, (almost 2018) and 2022. At the end of October, the AGG was in positive territory at +1.86% for the year. It would seem that it will be positive for the year, however, we are seeing more frequent examples of bonds not necessarily being a balance to equities.

What happens to the 60/40 approach in the next large market decline in such a scenario is a question investors should be asking. One idea is to pair exposure to market upside through futures and options-based market participation strategies with appropriate VIX-based hedges. If you can generate income through option writing, so much the better!

Comments